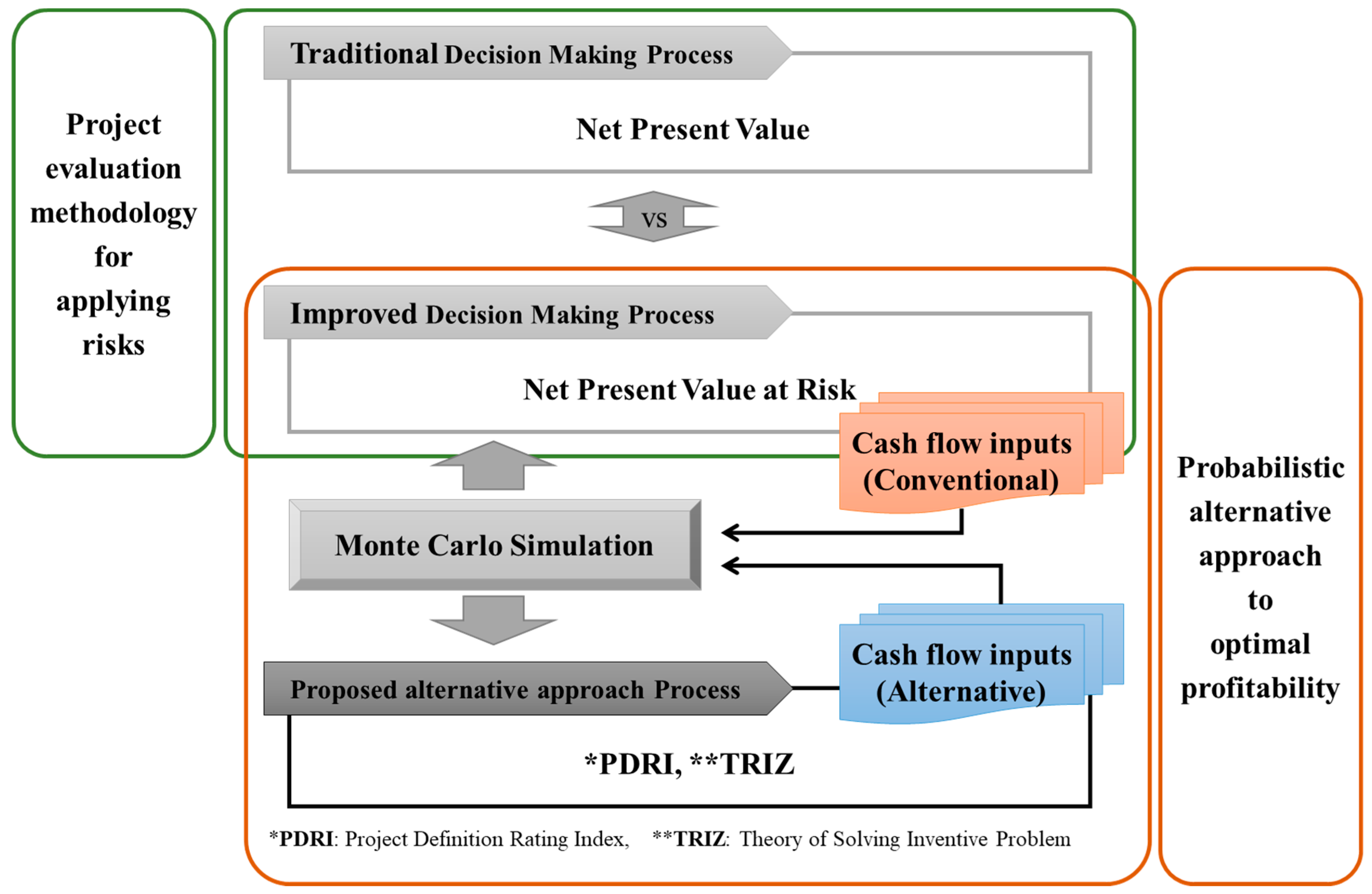

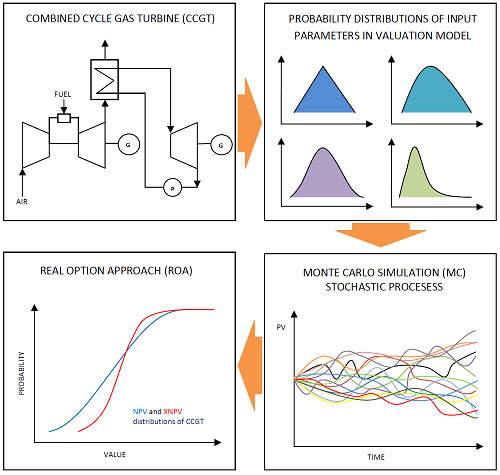

Energies | Free Full-Text | The Valuation of the Operational Flexibility of the Energy Investment Project Based on a Gas-Fired Power Plant

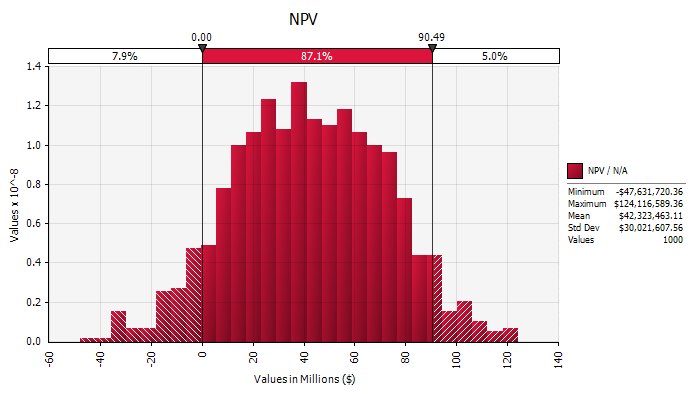

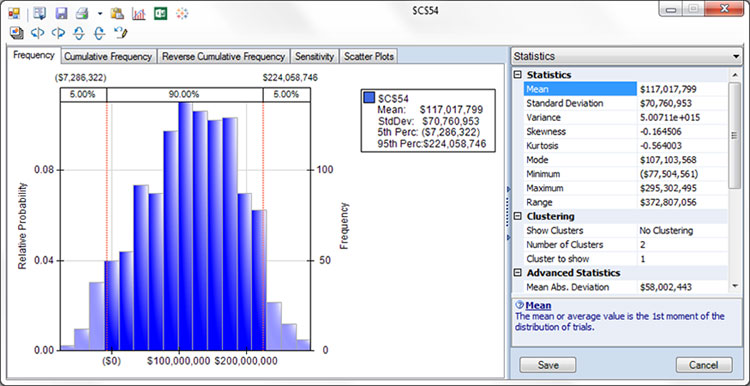

Summary of results of Monte Carlo simulation to determine net present... | Download Scientific Diagram

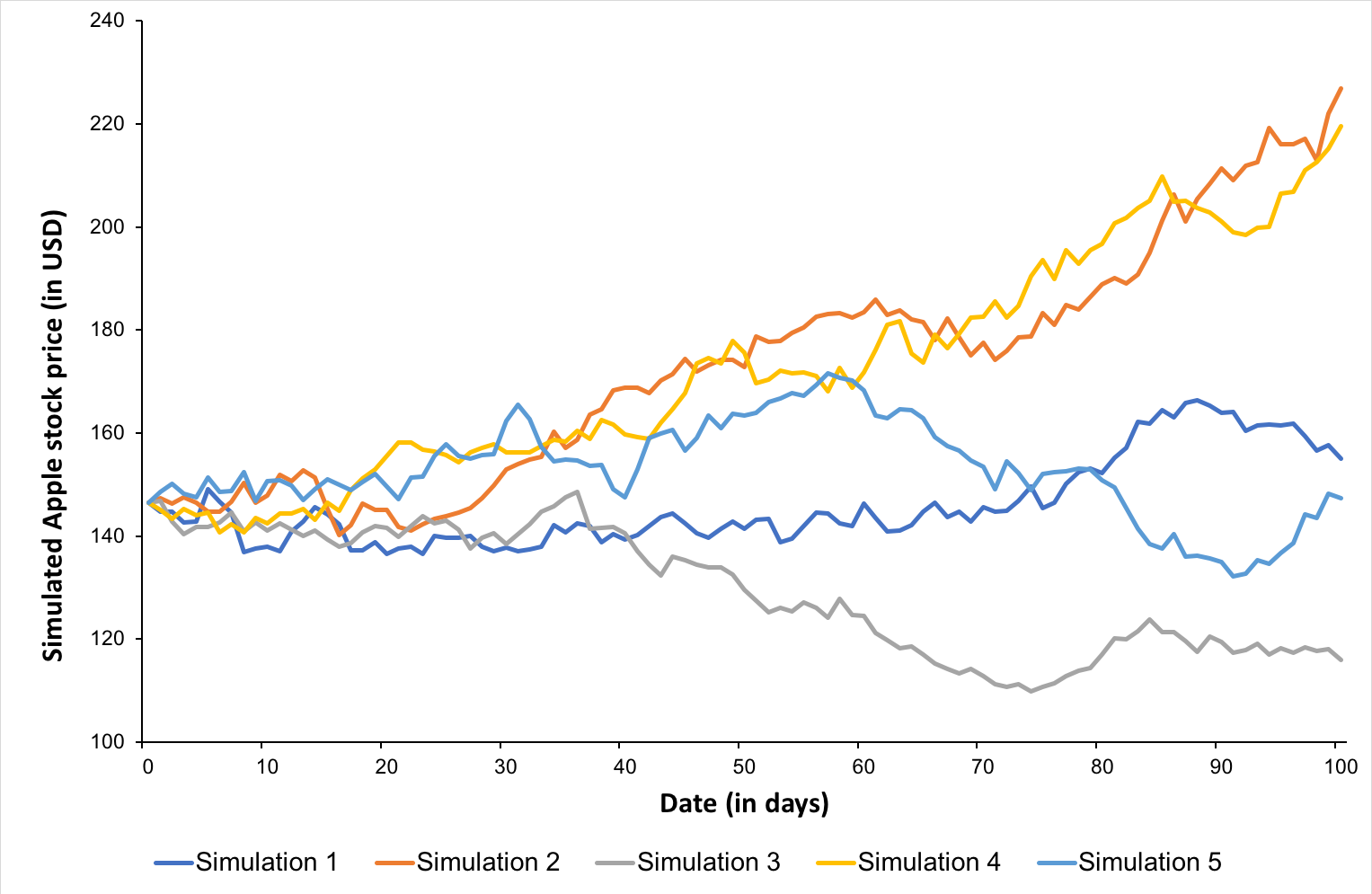

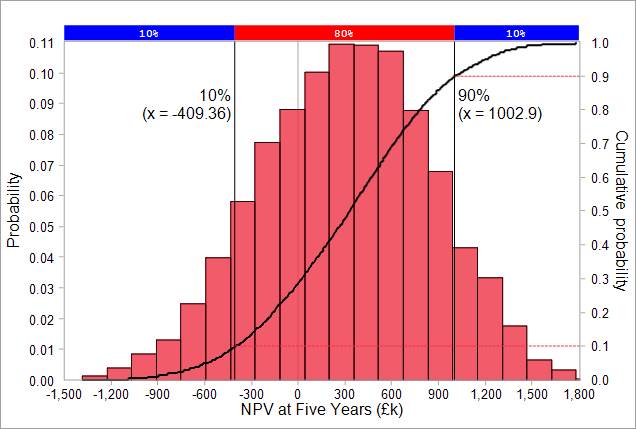

1000-point Monte Carlo simulation on; (a) net present values (NPV), (b)... | Download Scientific Diagram

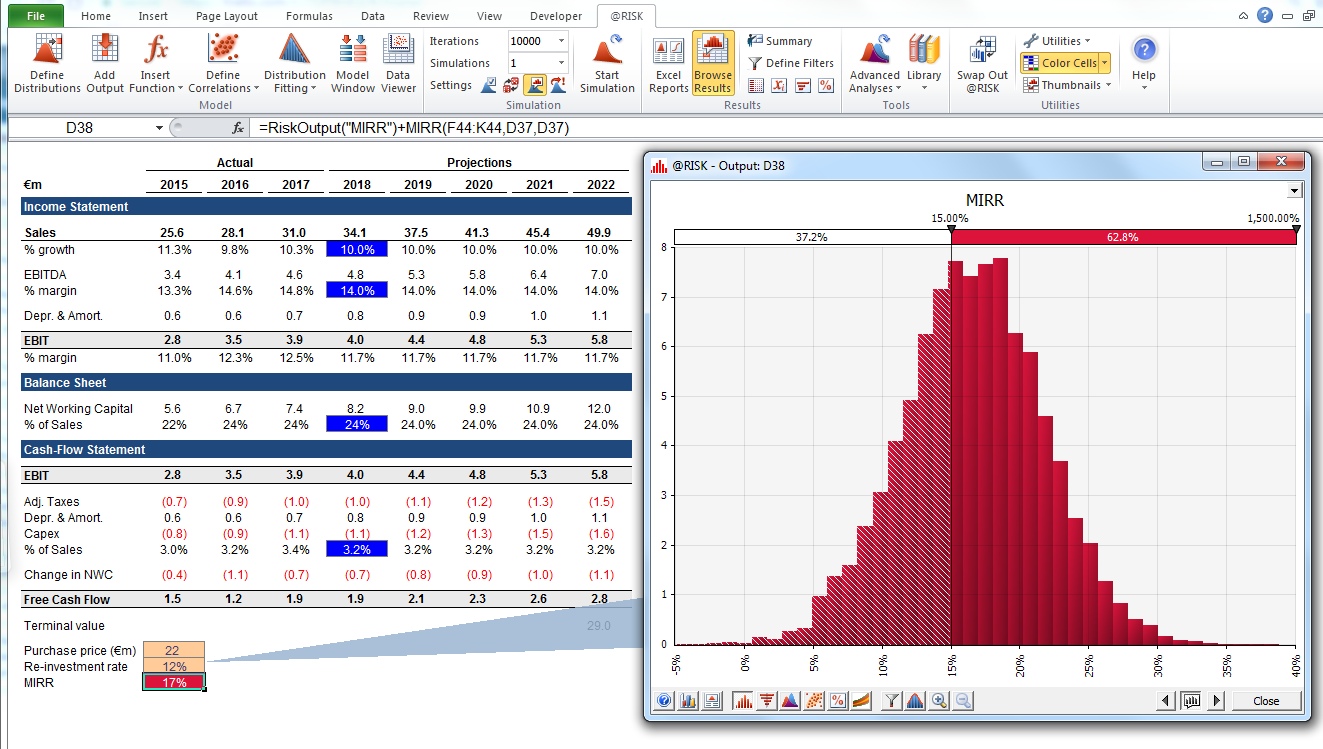

GitHub - pranavtumkur/Profitability-Analysis-using-Monte-Carlo-simulation: Using VBA Macros, we will determine if setting up a business would be profitable 15 years down the line, subject to 9 inputs, each associated with a certain uncertainty (

Distribution of the NPV per scenario (Monte Carlo simulation-authors). | Download Scientific Diagram